Hybrid Line of Credit: Flexible Funding Options from Your Wyoming Credit Union

Hybrid Line of Credit: Flexible Funding Options from Your Wyoming Credit Union

Blog Article

Elevate Your Financial Experience With Credit Score Unions

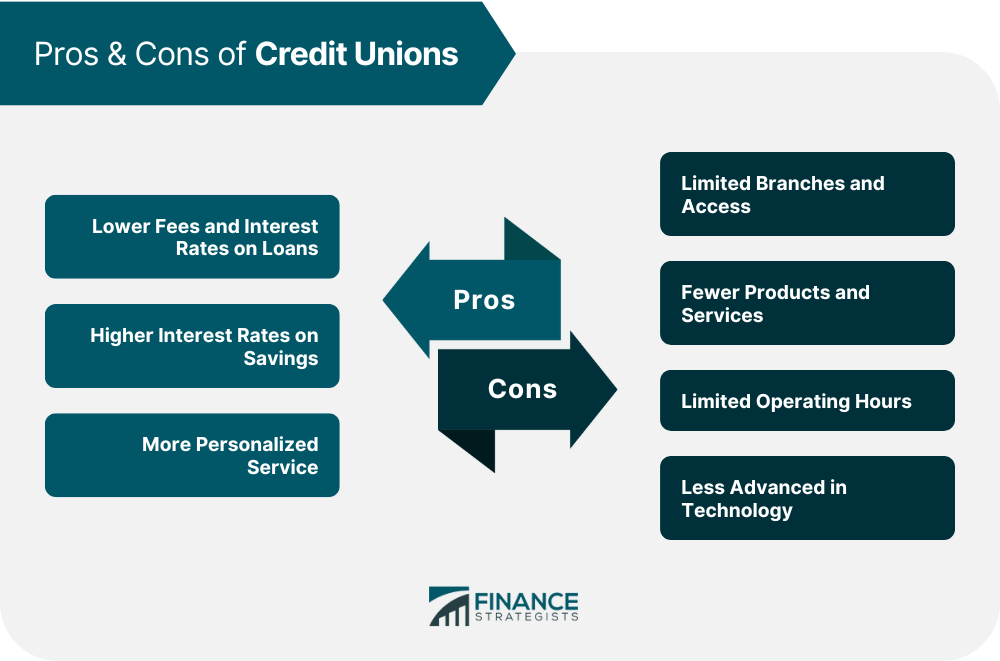

Credit report unions, with their focus on member-centric services and area involvement, offer an engaging choice to standard banking. By prioritizing private needs and fostering a sense of belonging within their membership base, credit rating unions have actually carved out a niche that resonates with those seeking a more personalized technique to managing their financial resources.

Benefits of Debt Unions

:max_bytes(150000):strip_icc()/6-benefits-of-using-a-credit-union.aspx_final-6e501699186e429ab6458d9e36ebe4a1.jpg)

One more advantage of credit rating unions is their autonomous structure, where each member has an equal vote in electing the board of directors. Credit scores unions commonly offer monetary education and therapy to aid participants boost their financial proficiency and make educated choices concerning their money.

Membership Needs

Cooperative credit union typically have specific requirements that people must fulfill in order to end up being members and gain access to their monetary solutions. Membership requirements for cooperative credit union commonly include qualification based on factors such as an individual's place, company, business affiliations, or other certifying connections. For example, some lending institution might offer people who live or work in a particular geographical area, while others may be associated with certain companies, unions, or associations. Furthermore, relative of current lending institution participants are usually eligible to join also.

To end up being a member of a credit score union, individuals are usually needed to open an account and preserve a minimal deposit as specified by the establishment. In some situations, there might be one-time membership costs or continuous subscription dues. As soon as the membership criteria are fulfilled, individuals can take pleasure in the advantages of belonging to a credit history union, including access to customized monetary solutions, competitive rates of interest, and an emphasis on member contentment.

Personalized Financial Services

Individualized monetary solutions customized to specific demands and choices are a hallmark of lending institution' dedication to member contentment. Unlike standard financial institutions that frequently use one-size-fits-all services, cooperative credit union take a much more tailored technique to handling their participants' funds. By comprehending the special objectives and scenarios of each member, cooperative credit union can give tailored suggestions on savings, investments, loans, and various other monetary items.

Additionally, cooperative credit union typically use reduced fees and competitive rates of interest on savings and financings accounts, additionally improving the personalized economic solutions they provide. By concentrating on private requirements and supplying customized options, cooperative credit union set themselves apart as relied on monetary companions committed to aiding participants flourish monetarily.

Area Participation and Assistance

Area involvement is a foundation of lending institution' mission, showing their dedication to supporting regional initiatives and promoting significant connections. Lending institution actively join neighborhood occasions, enroller regional charities, and arrange economic literacy programs to enlighten non-members and participants alike. By buying the neighborhoods they serve, cooperative credit union not just reinforce their connections but additionally add to the general well-being of culture.

Sustaining local business is another method cooperative credit union show their dedication to local communities. With providing small business finances and monetary advice, cooperative credit union aid entrepreneurs thrive and promote economic growth in the area. This assistance goes past just financial aid; lending institution typically give mentorship and networking possibilities to aid tiny organizations are successful.

In addition, cooperative credit union often engage in volunteer job, encouraging their participants and workers to provide back through various check that social work activities - Credit Union in Wyoming. Whether it's taking part in Find Out More regional clean-up events or arranging food drives, credit score unions play an active duty in boosting the lifestyle for those in need. By prioritizing community involvement and assistance, lending institution absolutely symbolize the spirit of participation and shared aid

Online Financial and Mobile Apps

Credit score unions are at the leading edge of this digital makeover, offering participants safe and secure and practical means to handle their financial resources anytime, anywhere. On-line financial solutions offered by credit rating unions allow participants to examine account balances, transfer funds, pay costs, and watch deal background with just a few clicks.

Mobile apps offered by debt unions better improve the financial experience by providing additional flexibility and accessibility. Generally, debt unions' on the internet banking and mobile apps empower members to manage their funds successfully and safely in today's fast-paced digital globe.

Verdict

In final thought, credit history unions provide an unique financial experience that prioritizes neighborhood involvement, individualized solution, and participant contentment. With lower charges, competitive rate of interest prices, and tailored economic solutions, debt unions cater to private requirements and advertise monetary health.

Unlike banks, credit unions are not-for-profit organizations owned by their participants, which usually leads to lower charges and far better rate of interest prices on cost savings accounts, fundings, and credit report cards. In addition, credit score unions are known for their individualized customer solution, with personnel members taking the time to recognize the special economic objectives and difficulties of each participant.

Credit scores unions frequently provide monetary education and therapy to assist members enhance their economic literacy and make informed choices regarding their go right here cash. Some credit report unions may serve individuals that work or live in a certain geographical location, while others may be connected with particular business, unions, or associations. In addition, family members of existing credit history union members are typically eligible to join as well.

Report this page